31+ 2nd home mortgage requirements

Todays 10 Best 2nd Mortgage Rates. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

221 Long Lake Ave Alpena Mi 49707 Zillow

Compare Lenders And Find Out Which One Suits You Best.

. For instance a buyer who. Web If someone purchases a new property beyond their current home and plans to live there for at least part of the year that is generally considered a second home. Web While specifics may vary by lender to qualify for a second home loan youll typically need.

Rates Qualifying and Underwriting Debt-to-income ratio DTI. Ad Use Your Home Equity Increase Your Home Value. Apply Directly to Multiple Lenders.

Web Second home mortgage requirements The most important requirement of second home mortgage is that you should deposit at least a 10 down payment. Monthly Budgeting You may be approved for a second mortgage on paper. Like any type of loan lenders look at your credit history.

Top Lenders Reviewed By Industry Experts. Web Heres what youll typically need to qualify for a second home loan. Ad Compare Find the 10 Best Pre Approval Mortgage In US.

Web Second Home Mortgage Details. Ad Lock In a Low Interest Rate for Your 2nd Mortgage Loan. Web The minimum mortgage deposit you would need on a second home would be 10 ie.

Web This is largely due to the fact that lenders issuing a second mortgage stand to lose more if you default on your payments. Getting pre-approved gives you an idea of your budget so you can shop for a home. A lower debt-to-income ratio usually less.

At least 20 of the purchase price as a down payment. Then multiply it by 08 and subtract your existing loan balance. Web The first step to taking out a second mortgage is getting pre-approved for a loan.

Lock Rates Before Next Rate Hike. Conventional loans backed by Fannie and Freddie typically require no more than. Ad Find The Best Second Mortgage Rates.

Apply Easily Save. Ad Were Americas 1 Online Lender. Generally speaking the more you put.

To balance out the risks on second homes lenders expect. A high credit score and impeccable credit reports The ability to meet. We do not offer 95 LTV residential mortgages on second.

Apply Online Get Easily Approved Today. Apply Start Your Home Loan Today. Web To find out how much you can borrow on a second mortgage first estimate your home value.

Ad Updated FHA Loan Requirements for 2023. Web There are several aspects of your finances that lenders look at for second home mortgage requirements. Fees are usually higher on a refinance than.

Web Most lenders require a DTI of 43 or less to get approved for a second mortgage. Compare 2023s Best 2nd Mortgage Lenders. Ad An Exceptional Approach So That You Feel at Home.

9 x. Using the previously mentioned example heres how you can determine how much you can borrow. If the lender identifies rental income from the property the loan is eligible for delivery as a second home as long as the income is not used for qualifying purposes.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Ad An Exceptional Approach So That You Feel at Home. Web Second home mortgage requirements for borrowers The most important requirement for a second home loan is that you need at least a 10 down payment.

Check out Pre-qualified Rates for a 2nd Mortgage Loan. Web Debt-to-income DTI requirements for a second home mortgage may depend on your credit score and the size of your down payment. Apply Get Fast Pre Approval.

Check Your Official Eligibility Today. Web Second home mortgage requirements including a minimum credit score of 620 a debt-to-income ratio of 50 or less a 10 minimum down payment and you may. Find Your Best Offers.

A 90 LTV mortgage. Web CLTV Loan Amount Mortgage Balances Home Value. Start Understanding Your Goals Risks and Time Horizon.

Web In addition lenders want a healthy debt-to-income ratio on second mortgages just as much as on the first and prefer a ratio of no more than 28 percent. Web Mortgages for second homes have stricter requirements than those for primary residences. Take the First Step Towards Your Dream Home See If You Qualify.

It is a non-negotiable. Start Understanding Your Goals Risks and Time Horizon.

What Is The Minimum Down Payment For A Second Home Guidelines Mortgage Criteria And More Vacation Property Online

Fannie Mae And Freddie Mac Guidelines On Second Home Loans

Lbcer8kex992 2020q4

Fannie Mae And Freddie Mac Guidelines On Second Home Loans

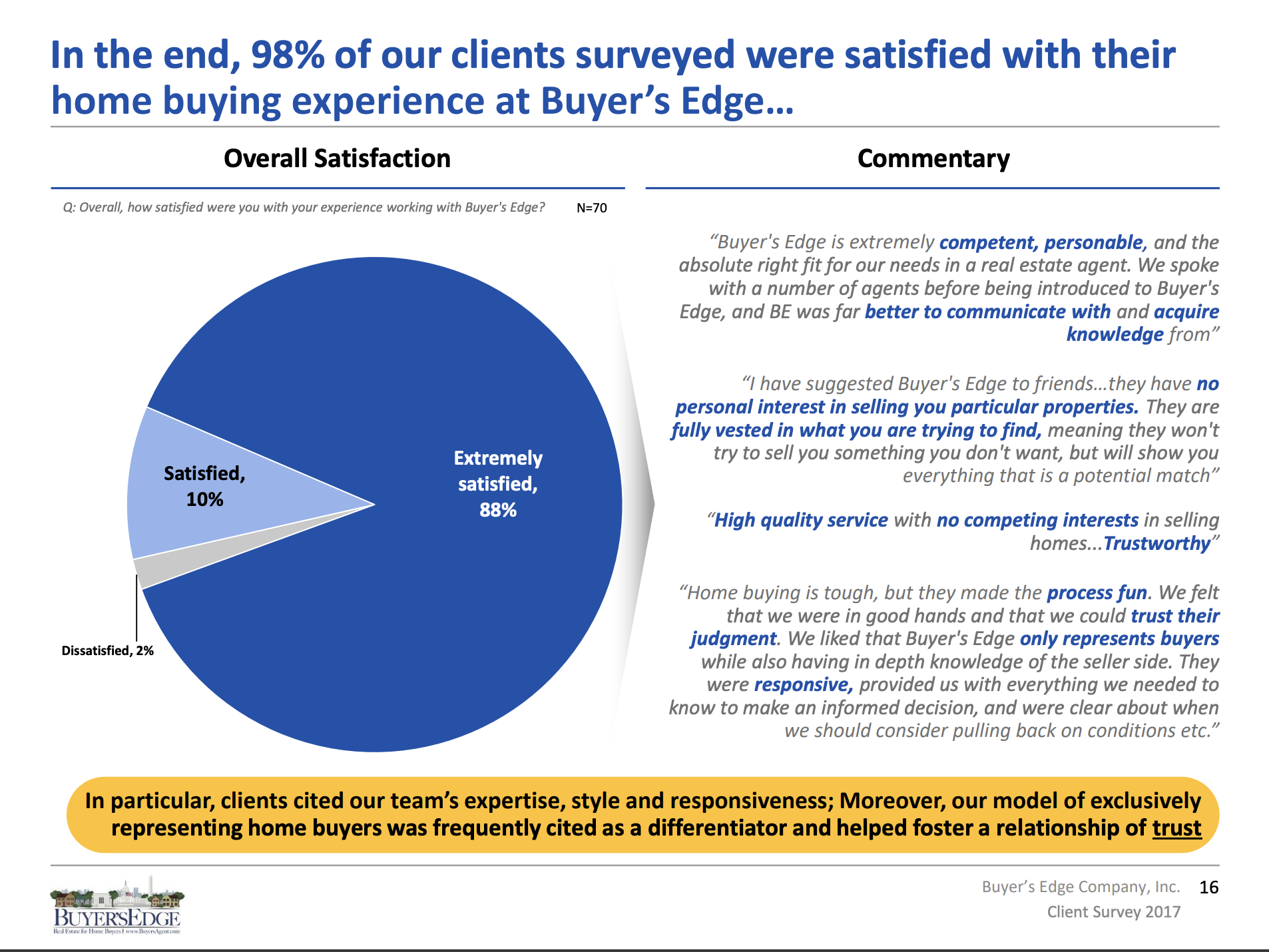

Meet Our Exclusive Buyer S Agents In Dc Md Va Buyer S Edge True Buyer Agents Dc Md Va Naeba Members Buyer S Edge Buyersagent Com

Sutton Cemetery Kountze Tx 77625 Realtor Com

Buyer S Edge Buyersagent Com Home Buying Process Client Feedback Survey True Buyer Agents Dc Md Va Naeba Members Buyer S Edge Buyersagent Com

Speakers 2023 Nahrep Homeownership Wealth Building Conference

Form Fwp

3182 Pineridge Dr Lewiston Mi 49756 Zillow

Handbook Final Qxd Securitization Net

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1915 Session I Education Thirty Eighth Annual Report Of The

1215 S 2nd Ave Alpena Mi 49707 Zillow

What Is The Minimum Down Payment For A Second Home Guidelines Mortgage Criteria And More Vacation Property Online

Hampden County Ma Luxury Homes Mansions High End Real Estate For Sale Redfin

Usda Loan Pros And Cons Usda Loan Understanding Mortgages Closing Costs

Solved All Listed Forms Will Be Used With An Agi Check Chegg Com